- Analytics

- Fundamental Analysis

- USD gains more

Investors forgetting Archegos Capital - USD gains more

Today, the USD index kept its uptrend started from January at 90.13 to reach five months high at 93.23. USD gains primarily based on vaccination progress, and plans for more stimulate packages lifted inflation expectations on higher Treasury yields. Last days' worries about the collapse of highly leveraged investment fund Archegos Capital also has been digested.

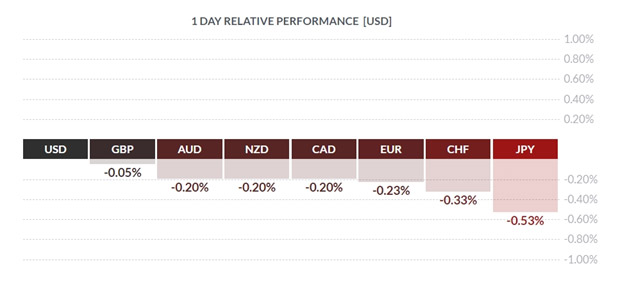

With a 0.3% gain, the USD Index helped the USD gain 0.5% against JPY and touched one year high in the USDJPY chart. The dollar rose above 110.40, a level not seen from March 2020.

There are two main reasons for that. Firstly because of higher inflation expectations in the United States than in Japan and ending the Japanese fiscal year at the end of this month. Both reasons are rising the demand for USD.

"USD/JPY has by far the highest correlation amongst G10 currencies with long-term US yields," said Lee Hardman, currency economist at MUFG, in a note. "Upward pressure on long-term US yields is expected to be supported by another fiscal stimulus policy announcement from the Biden administration."

However, as I mentioned earlier in another analysis, pricing too much on higher inflation risk is too dangerous in the market. We may see the market collapse and soften USD in the coming months.