- Analítica

- Análise Técnica

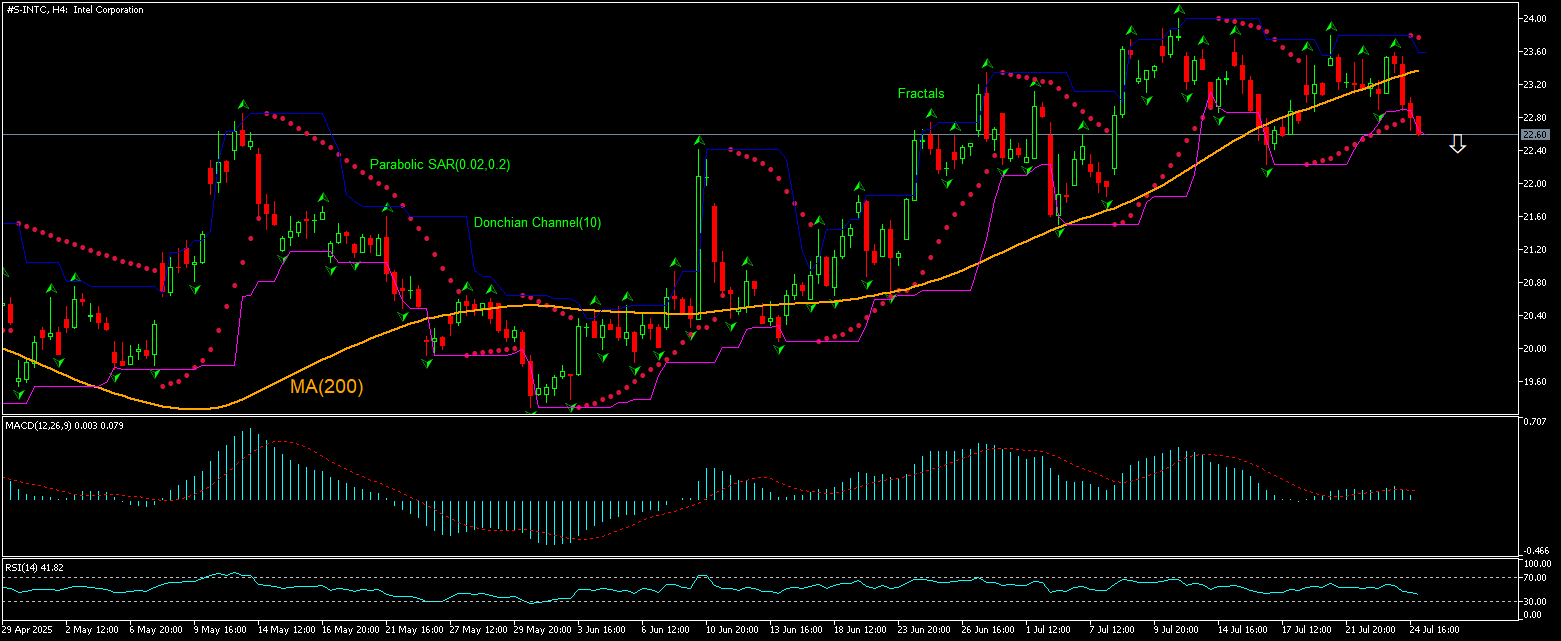

Intel Análise técnica - Intel Negociação: 2025-07-25

Intel Resumo da Análise Técnica

abaixo de 22.58

Sell Stop

acima de 23.59

Stop Loss

| Indicador | Sinal |

| RSI | Neutro |

| MACD | Vender |

| Donchian Channel | Vender |

| MA(200) | Vender |

| Fractals | Neutro |

| Parabolic SAR | Vender |

Intel Análise gráfica

Intel Análise Técnica

The technical analysis of the Intel stock price chart on 4-hour timeframe shows #S-INTC,H4 beached below the 200-period moving average MA(200) which is rising still. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 22.58. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 23.59. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (23.59) without reaching the order (22.58), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Análise Fundamental de Activos - Intel

Intel stock closed down on Thursday despite the chip maker reporting better than expected Q2 revenue. Will the Intel stock price continue declining?

Yesterday Intel reported Q2 revenue of $12.8 billion against an anticipated revenue of $11.8 billion. The chip maker had posted $12.8 billion in revenue in the same period last year. Intel said it took an $800 million non-cash impairment and accelerated depreciation charges related to "excess tools with no identified re-use" and roughly $200 million one-time period costs for Q2. The company said it will lay off 15% of its work force and expects to have approximately 75,000 employees by the end of the year. The chip maker revealed it has canceled planned projects in Germany and Poland and is slowing construction of its facility in Ohio. And while Intel offered an upbeat Q3 revenue forecast of between $12.6 billion and $13.6 billion, above Wall Street estimate of $12.6 billion, Intel stock closed down on the day as it gave back earlier gains of more than 2%. Despite better than expected second quarter Intel results and an upbeat guidance, continuing uncertainty about Intel’s turnaround remains a serious downside risk for Intel stock price.

Explore nossas

condições de trading

- Spreads a partir de0.0 pip

- 30,000+ Ferramentas de Trading

- Execução Instantânea

Ready to Trade ?

Abrir Conta Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.