- 분석

- 기술적 분석

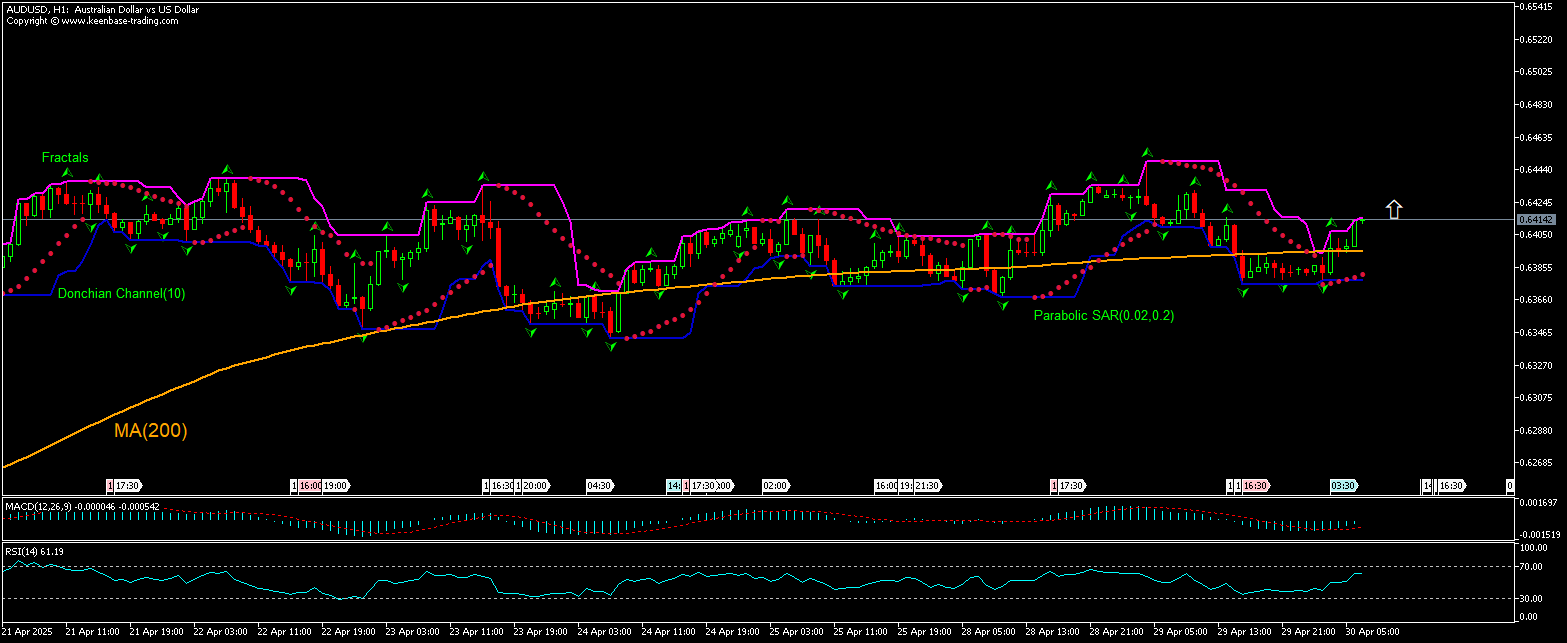

AUD USD 기술적 분석 - AUD USD 거래: 2025-04-30

AUD/USD 기술적 분석 요약

위에 0.64173

Buy Stop

아래에 0.63843

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 구매 |

| Donchian Channel | 구매 |

| MA(200) | 구매 |

| Fractals | 구매 |

| Parabolic SAR | 구매 |

AUD/USD 차트 분석

AUD/USD 기술적 분석

The technical analysis of the AUDUSD price chart on 1-hour timeframe shows AUDUSD,H1 has returned above the 200-period moving average MA(200) after falling below the MA(200) yesterday. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 0.64173. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 0.63843. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Forex - AUD/USD 기본 분석

Australia’s inflation remained steady in March. Will the AUDUSD price rebound continue?

Australian Bureau of Statistics reported the Consumer Price Index (CPI) increased by 2.4% over year in March, unchanged from the previous month when a decline to 2.3% was expected. The reading remained the lowest inflation rate since last November. The slowing of consumer prices for alcohol and tobacco, clothing and footwear as well as accelerating deflation in the transport sector was offset by higher prices for food and non-alcoholic beverages and housing. On a quarterly basis, consumer prices rose 2.4% in the first quarter, matching the previous quarter’s pace and slightly exceeding market expectations of 2.3%. However, core inflation eased to 2.9% from 3.3%, supporting the views of a near-term rate cut by the Reserve Bank of Australia at its meeting in May. Expectations of a rate cut by the RBA is bearish for Australian dollar and AUDUSD currency pair. However, the current setup is bullish AUDUSD.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.