- 분석

- 최고 승자 / 패자

Top Gainers and Losers: Australian Dollar and Swiss Franc

Top Gainers - Global Market

Top Gainers - Global Market

Over the past 7 days, the US dollar index has slightly decreased within a neutral range of 102.3-100.7 points. United States Nonfarm Payrolls for April was so good (+253k) that investors now do not rule out a reduction in the Fed rate as early as July. According to CME FedWatch, the probability of such an event is estimated at 35.4%. Note that other American economic indicators have also been positive lately. At the next FOMC meeting on June 14, the rate is likely to remain at the current level of 5.25%. The rise of the Australian dollar was supported by the Reserve Bank of Australia raising the rate on May 2 to 3.85% from 3.6%. In addition, Australia has released good data on foreign trade and retail sales. Statistics in New Zealand were also moderately positive. The Swiss franc fell as investors do not rule out a reduction in the Swiss National Bank rate (1.5%). Swiss inflation in April reached an 11-month low of +2.6% y/y, thus approaching the Swiss National Bank's target level.

1. CNOOC, +6% – China National Offshore Oil Corporation

2. Iluka Resources Ltd, +5.9% – Australian fertilizer producer

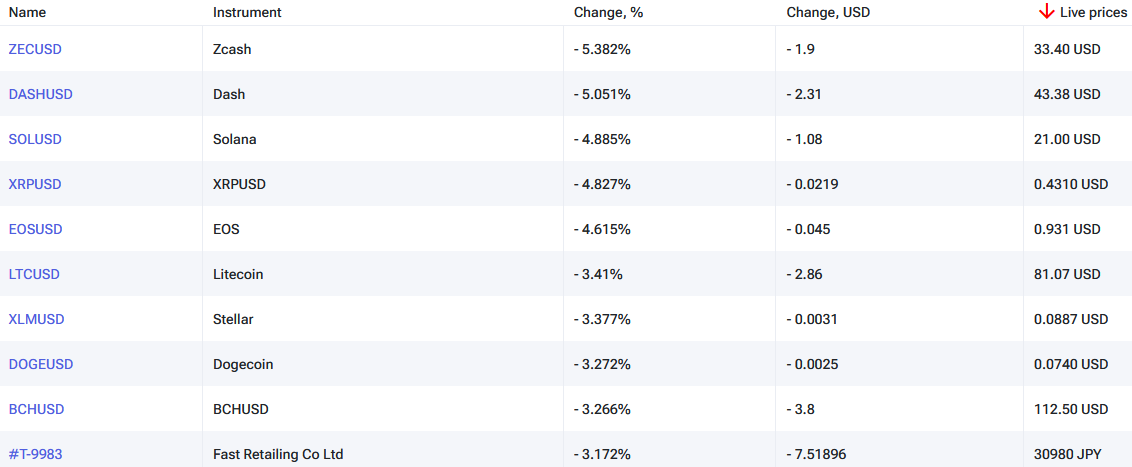

Top Losers - Global Market

Top Losers - Global Market

1. ZECUSD - Zcash (ZEC) cryptocurrency

2. DASHUSD - DASH (DSH) cryptocurrency.

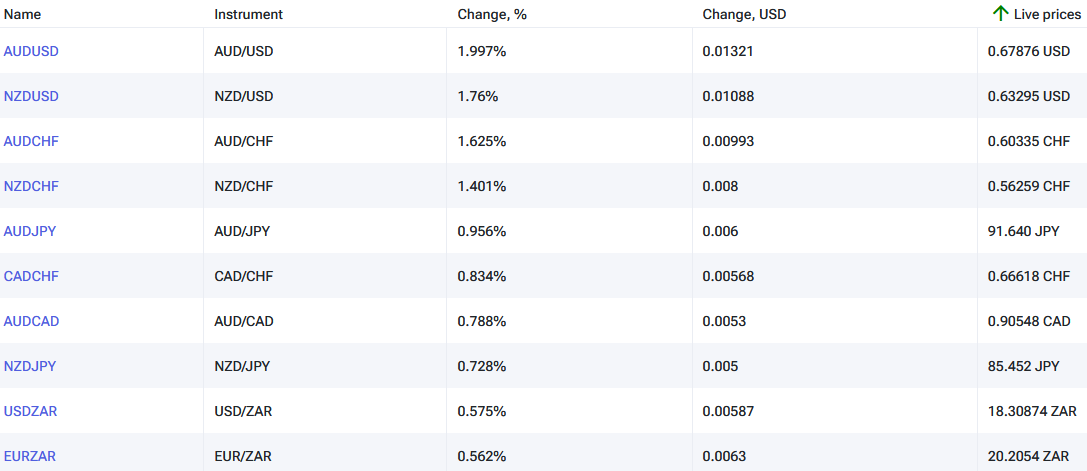

Top Gainers - Forex Market

Top Gainers - Forex Market

1. AUDUSD, NZDUSD - an increase in these charts indicates the strengthening of the Australian and New Zealand dollars against the US dollar.

2. AUDCHF, NZDCHF - the increase in the charts means the weakening of the Swiss franc against the Australian and New Zealand dollars.

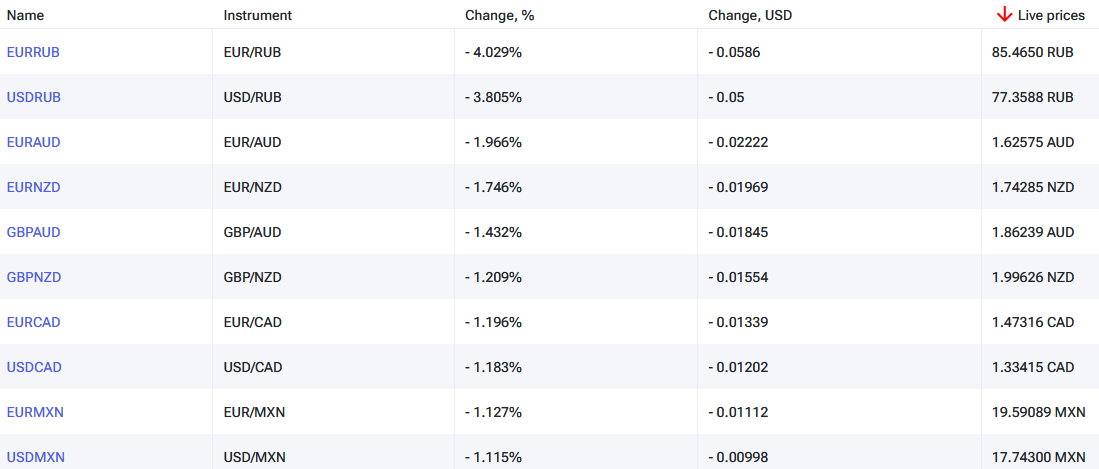

Top Losers - Forex Market

Top Losers - Forex Market

1. EURAUD, EURNZD - the decline in the charts means the weakening of the euro against the Australian and New Zealand dollars.

2. GBPAUD, GBPNZD - the decrease in the charts means the strengthening of the Australian and New Zealand dollars against the British pound.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.

LAST_TOPGAINERS

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...