- Analytics

- Technical Analysis

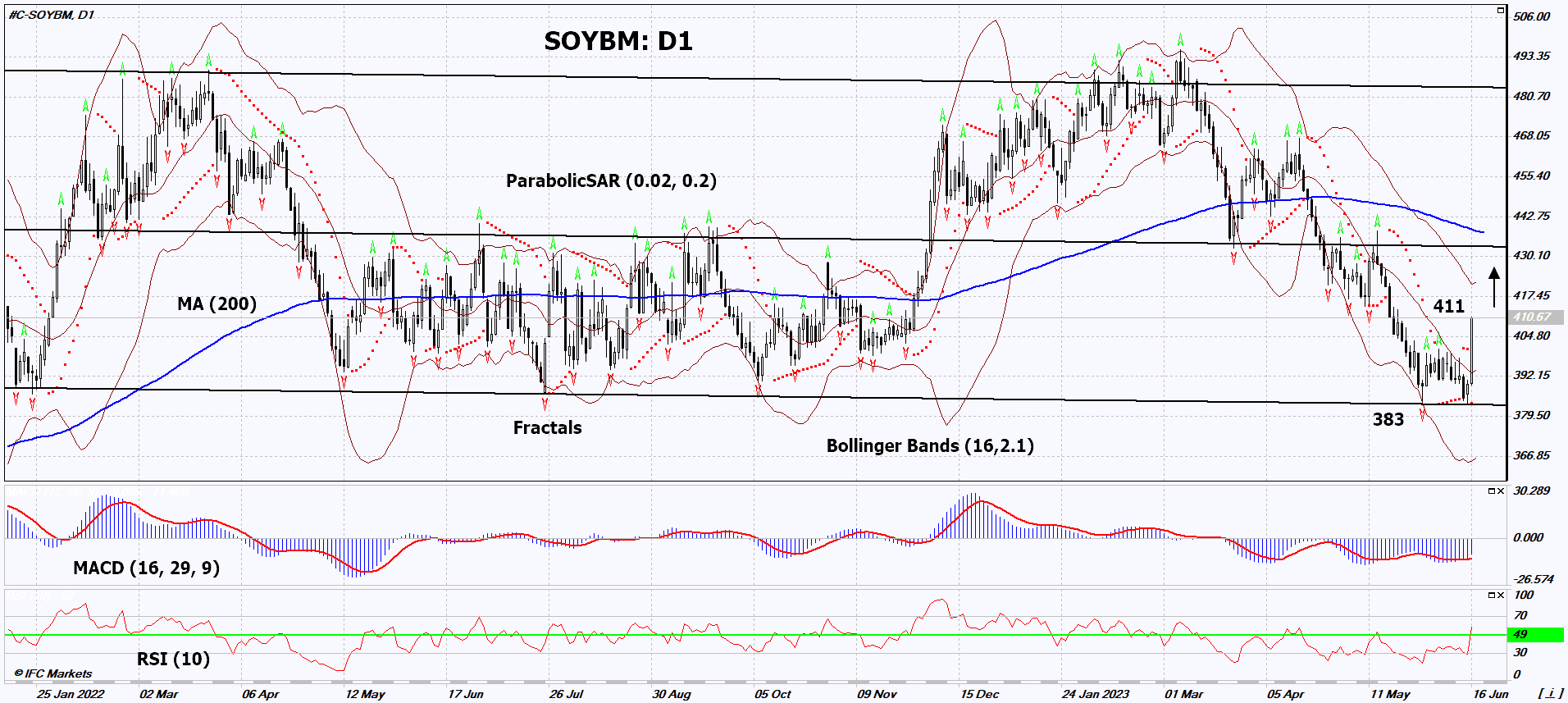

Soybean Meal Technical Analysis - Soybean Meal Trading: 2023-06-19

Soybean Meal Technical Analysis Summary

Above 411

Buy Stop

Below 383

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

Soybean Meal Chart Analysis

Soybean Meal Technical Analysis

On the daily timeframe, SOYBM: D1 failed to break below the lower boundary of the long-term neutral range and is now moving towards its upper boundary. It has formed a Double Bottom pattern. Several technical analysis indicators have generated signals for further upside movement. We do not rule out a bullish trend if SOYBM: D1 rises above the last peak at 411. This level can be used as an entry point. The initial risk limit can be placed below the Parabolic signal and the last lower fractal at 383. After opening a pending order, the stop-loss should be moved along with the Bollinger Bands and Parabolic signals to the next fractal low. This way, we adjust the potential profit/loss ratio in our favor. The most cautious traders can switch to the four-hour chart after entering the trade and adjust the stop-loss by moving it in the direction of the movement. If the price surpasses the stop level (383) without activating the order (411), it is recommended to cancel the order as internal changes are taking place in the market that were not accounted for.

Fundamental Analysis of Commodities - Soybean Meal

A global drought could cut crop yields. Will SOYBM quotes continue to grow?

A lack of rainfall has been observed in the United States, Latin America, and Europe. The United States Department of Agriculture (USDA) assessed the quality of American soybean crops last week and reported them as "good and excellent" at a rate of 59% of the total area. In the same week of 2022, the proportion of crops rated as good and excellent was significantly higher at 70%. It is worth noting that the USDA still expects soybean production in the United States to increase by approximately 5.5% in the 2023/2024 season compared to the 2022/2023 season, reaching 122.74 million metric tons. Meanwhile, global soybean production in the current season could increase by 11.1% to 410.7 million metric tons. However, as the crop quality deteriorates, these forecasts theoretically could be revised downwards. It is important to mention that on June 19, American markets are closed due to the Juneteenth holiday.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.