- 분석

- 기술적 분석

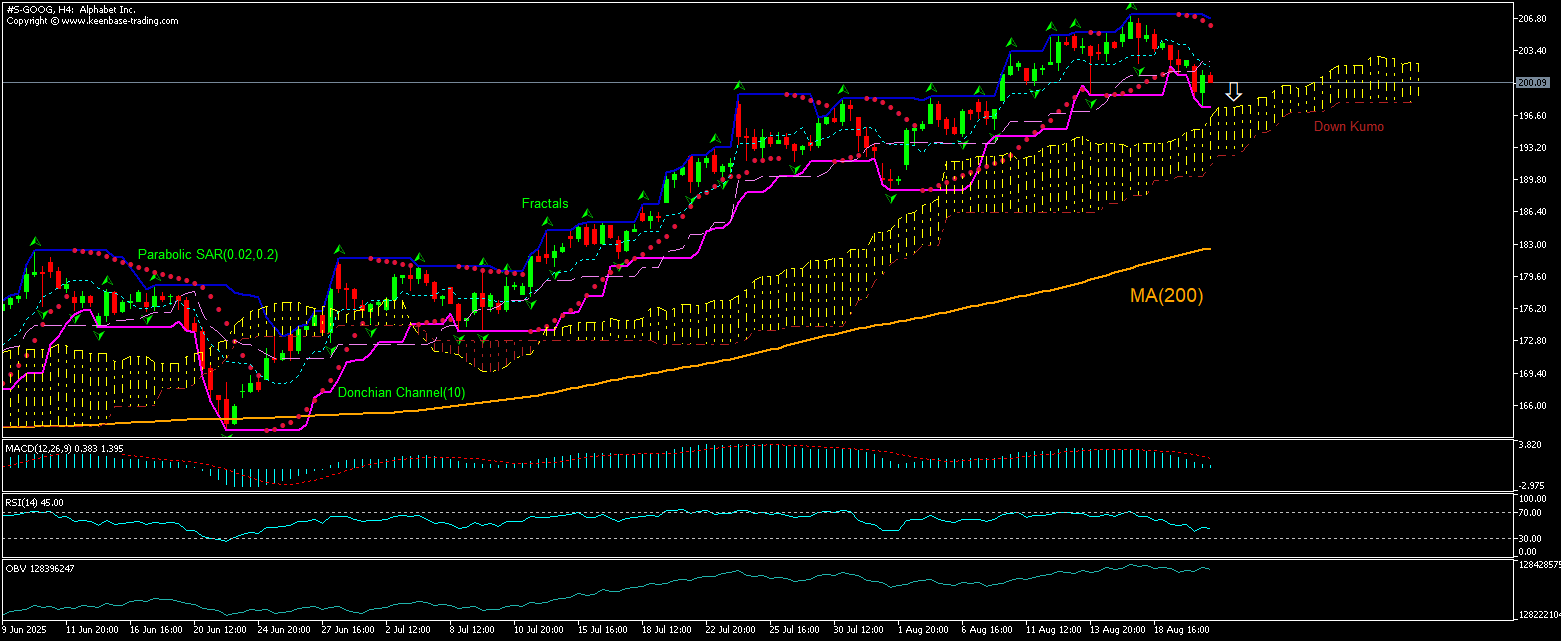

Google 기술적 분석 - Google 거래: 2025-08-21

Alphabet Inc. 기술적 분석 요약

아래에 197.39

Sell Stop

위에 206.08

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 판매 |

| Donchian Channel | 판매 |

| MA(200) | 구매 |

| Fractals | 중립적 |

| Parabolic SAR | 판매 |

| On Balance Volume | 판매 |

| Ichimoku Kinko Hyo | 구매 |

Alphabet Inc. 차트 분석

Alphabet Inc. 기술적 분석

The technical analysis of the GOOGLE stock price chart on 4-hour timeframe shows #S-GOOG,H4 is retreating down toward the 200-period moving average MA(200) after rebounding to six-month high six days ago. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 197.39. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 206.08. After placing the order, the stop loss is to be moved every day to the fractal high indicator following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (206.08) without reaching the order (197.39), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

지수 - Alphabet Inc. 기본 분석

Alphabet stock continued declining after the company revised its Google Play terms. Will the GOOGLE stock price retreating reverse?

The stock of Alphabet, Google’s parent company, fell 1.14% on Wednesday after reports the company is updating its External Offers Program for the European Union with revised fees and more options for Android developers. Alphabet has made updates to its external offers program to offer more flexibility for developers as part of its continued compliance with the EU Digital Markets Act, or DMA. In March, the EU competition watchdog found Google failed to comply with the region's DMA for two services. The Commission alleged that parent Alphabet treats Google Shopping, Hotels, Flights, etc., "more favorably" in search results versus services offered by third parties and gives "more prominent treatment" to its own offerings. Furthermore, the EC said the company's app store Google Play prevents developers from steering customers to offers and distribution channels of their choice and unjustly charges them for customer acquisition. Revised Google Play terms are designed to make it easier for app developers to steer customers to platforms other than Google after the European Commission found that the company allegedly breached EU's rules. Developers must meet eligibility requirements, and complete their enrollment in this program before promoting external offers. Revision of search results terms that will restrict the favorable treatment of services offered by Google versus services offered by third parties is bearish for Google stock price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.