- 분석

- 기술적 분석

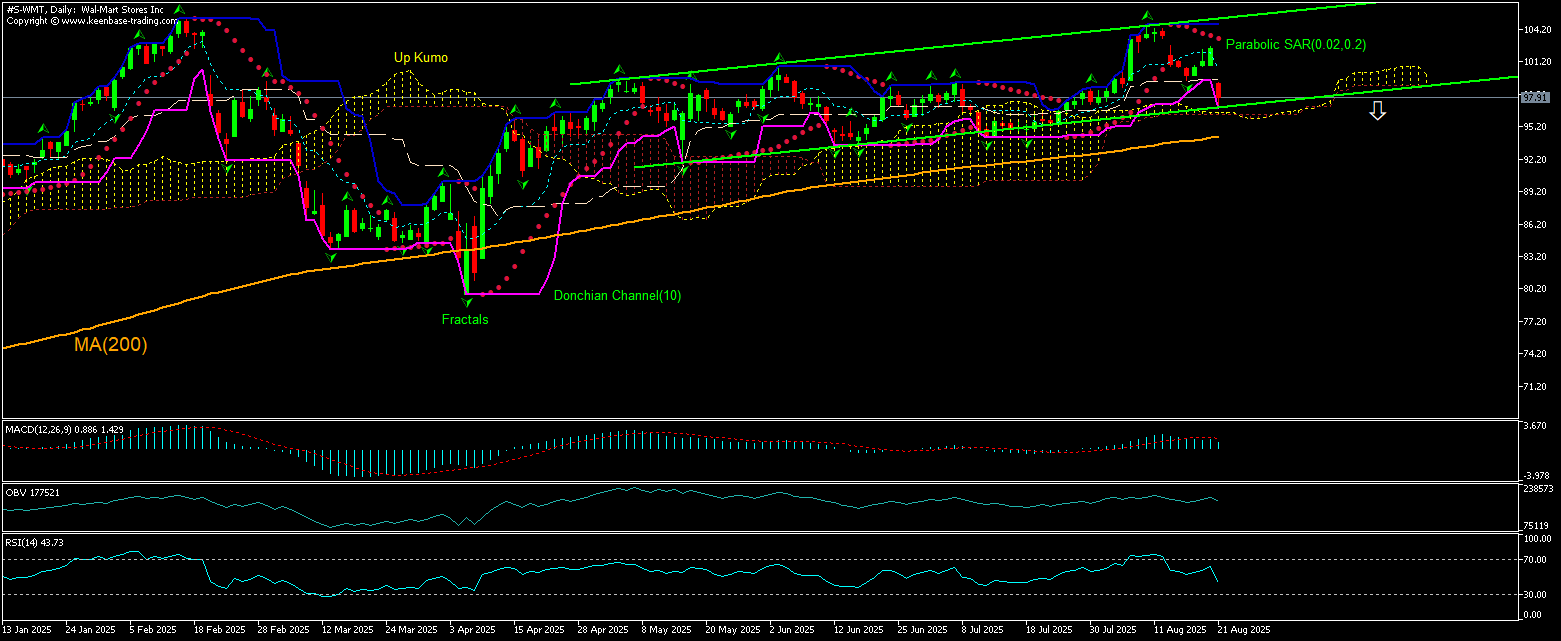

Walmart 기술적 분석 - Walmart 거래: 2025-08-22

Walmart 기술적 분석 요약

아래에 96.35

Sell Stop

위에 103.35

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 판매 |

| Donchian Channel | 판매 |

| MA(200) | 구매 |

| Fractals | 중립적 |

| Parabolic SAR | 판매 |

| On Balance Volume | 판매 |

| Ichimoku Kinko Hyo | 구매 |

Walmart 차트 분석

Walmart 기술적 분석

The technical analysis of the Walmart stock price chart on 4-hour timeframe shows #S-WMT,H4 is retracing down toward the 200-period moving average MA(200) after hitting 6-month high 2 weeks ago. We believe the bearish momentum will resume after the price breaches below the lower Donchian bound at 97.91. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed at 103.35. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (103.35) without reaching the order (96.35), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

지수 - Walmart 기본 분석

Walmart stock tumbled after Q2 earnings missed Wall Street estimates. Will the Walmart stock price continue retreating?

Walmart stock fell 4.5% yesterday as earnings missed Wall Street estimates. The stock sold off despite 4.8% rise in Q2 sales to $177.4 billion which beat the consensus revenue estimate of $175.5 billion. Overall gross margins were about flat at 24.5% versus 24.4% last quarter, missing consensus estimates of 24.9%. On a constant-currency basis, revenues grew 5.6%, reflecting strong performance across all business segments. Walmart stock sold off despite reporting better results than rival Target. Walmart's comparable sales growth at stores open at least one year was 4.6% in Q2, up from 4.2% one year ago. Transactions rose 1.5%, down from 3.6% last year, while average ticket, or the amount spent per transaction, rose 3.1%, up from 0.6%. For comparison, Target reported a 1.9% comparable sales decline and an online sales growth of only 4.3% in the quarter. The retail and wholesale giant indicated the average ticket growth was partly due to inflation and passing along higher costs associated with tariffs, which increased Walmart's import costs, and the company would increase prices this summer as announced earlier to offset tariff-related costs. Walmart said it continued to see cost increases each week as inventory was replenished at post-tariff price levels and those costs will continue rising in the second half of the year. However, the company reported tariff impact wasn't as big as expected so far as Walmart has raised prices maybe 1% since the end of the first quarter. The company’s operating income decreased 8.2% year over year to $7.3 billion. The company cited tariffs as the primary challenge, as well as discrete legal and restructuring costs. Adjusted operating income is up 0.4% in current currency terms. Still, management raised its full-year guidance: sales guidance was increased to 3.75% to 4.75% growth from 3% to 4% prior forecast while operating income growth guidance was unchanged - up 3.5% to 5.5%. Higher than expected revenue growth and guidance is bullish for Walmart stock price while earnings miss is a downside risk.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.